India's First PMS Product For Monthly Income And Capital Protection.

As Featured In

What

Separates FactorCapro

15+ years of experience in developing equity and fixed income products. Introduced and managed investment strategies totaling more than USD 5 billion at Index Capital. Specialized in serving AMCs, ETF sponsors, hedge funds and pension funds. Leveraging expertise in factor investing and quantitative research, he came up with a suite of ETF and equity portfolios at Elever, designed to outperform market benchmarks across market cycles.

The Elever Difference

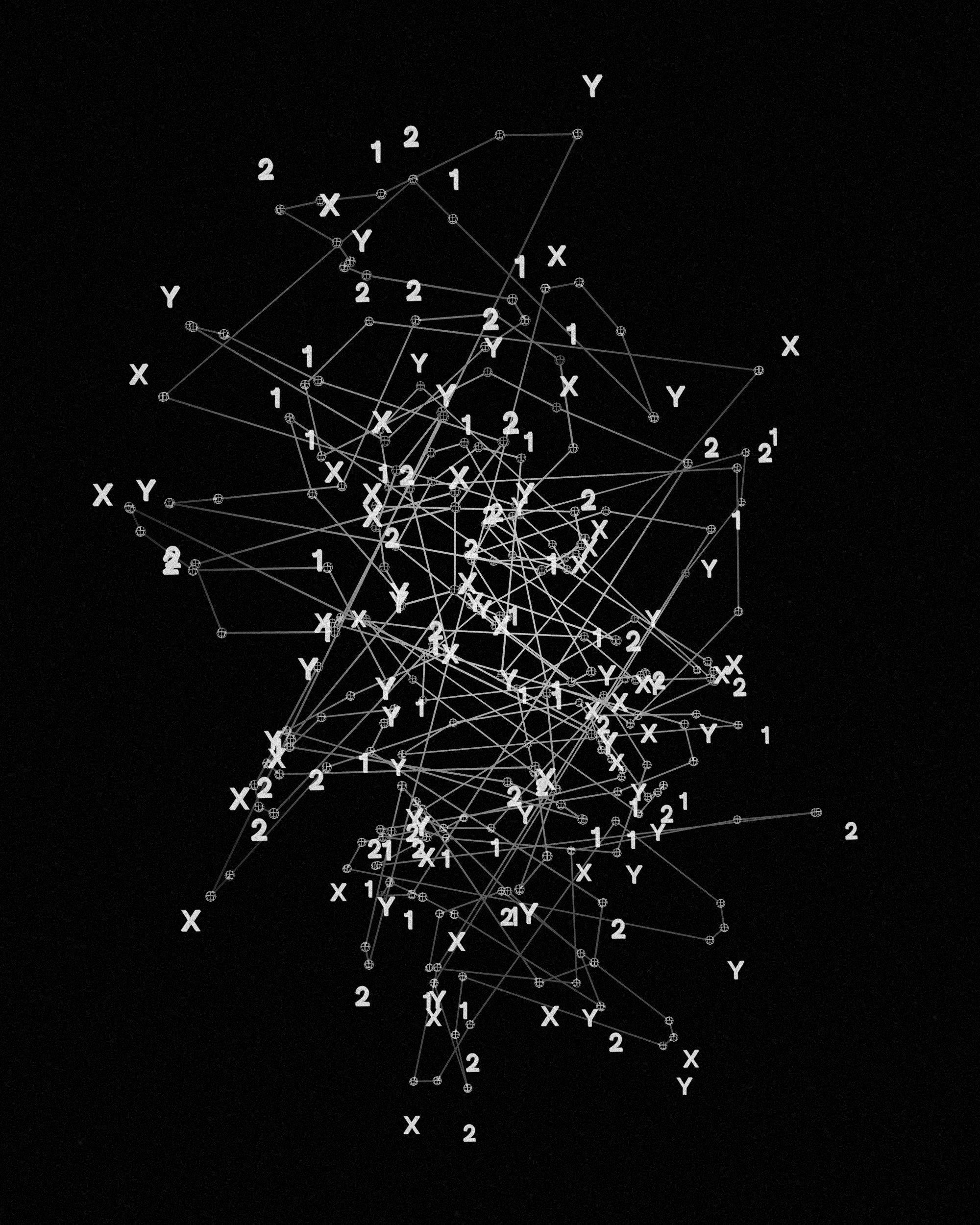

Factor Focused

500+ factors analyzed over 17 years to create algorithms that identify market winners across market cycles

Tactical Quants

We use machine learning to optimize factor rotation and enhance alpha adjusting to changing market conditions

Rule-based Investing

Our rule-based investment decisions, tested over different market conditions, eliminate human and emotional bias found in stock picking

Risk Management

Multi-layered risk control with tactical calls and hedging to guard against market extremes

Our Schemes

FactorCapro

Delivers regular income by combining the stability of debt with factor-driven multi-asset investing, to neutralize market timing risk. It’s designed to enhance post-tax returns while preserving principal — even in severe market downturns.

* Income would be suspended/delayed if client portfolio is at or below INR 50 Lakhs.

FactorAlpha (Smallcap)

A tactical factor rotation approach, this seeks to negate the timing risk in small-cap alpha and enhance the size premium over the mid and long term.

FactorAlpha

A tactical approach to Factor Investing. It allocates funds to suitable factors in line with market situations adding a multiplier impact on long-term outperformance.

FactorCore

A Tactical risk rotation designed for low cost, all season asset allocation through core satellite approach, using rule-based index factor funds

FactorShields

A tactical factor rotation strategy, which adjusts exposure based on prevailing market conditions, to significantly enhance risk-adjusted returns for risk-conscious investors.

FactorIncome

A scheme that aims to deliver a monthly income (from Month 13) with compounding by diversifying equity portfolios with low correlated assets such as debt, gold, and international equities.

* Income would be suspended/delayed if client portfolio is at or below INR 50 Lakhs.

We’ve Got the Answers You’re Looking For